Subscribe if you want to be notified of new blog posts. You will receive an email confirming your subscription.

Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part II)

by Vince Kuraitis, JD/MBA and Randy Williams, MD

In Part I of this series, we defined platform “envelopment” strategies. In short, platform companies can leverage an existing user base and existing capabilities into new markets. We then documented seven of Amazon’s leverage points in potentially deploying envelopment strategies in healthcare:

- A Huge User Base

- A Loyal User Base

- Provision of Hybrid Clinical Care

- Deep Pockets

- A National and International Footprint

- One-Stop-Shopping for Employers?

- Digital Front Door for Healthcare?

In Part II of this series, we take these seven leverage points and compare Amazon’s ability to deploy envelopment strategies with companies in five other sectors of healthcare:

- Virtual care platforms

- Other Big Tech

- Retail Pharmacy

- Other Big Retail

- Regional health systems

As we noted in Part I, “envelopment” originally refers to a military flanking maneuver — an attack to the side or rear that avoids the enemy’s frontal strengths. Our intent is to illustrate the power of platform envelopment strategies and to specify some of Amazon’s potent options. We’re not forecasting Amazon’s success, and we’re not suggesting competitors are defenseless — they have many other strategic options.

Amazon’s Leverage Points to Deploy Envelopment Strategies: A Comparison

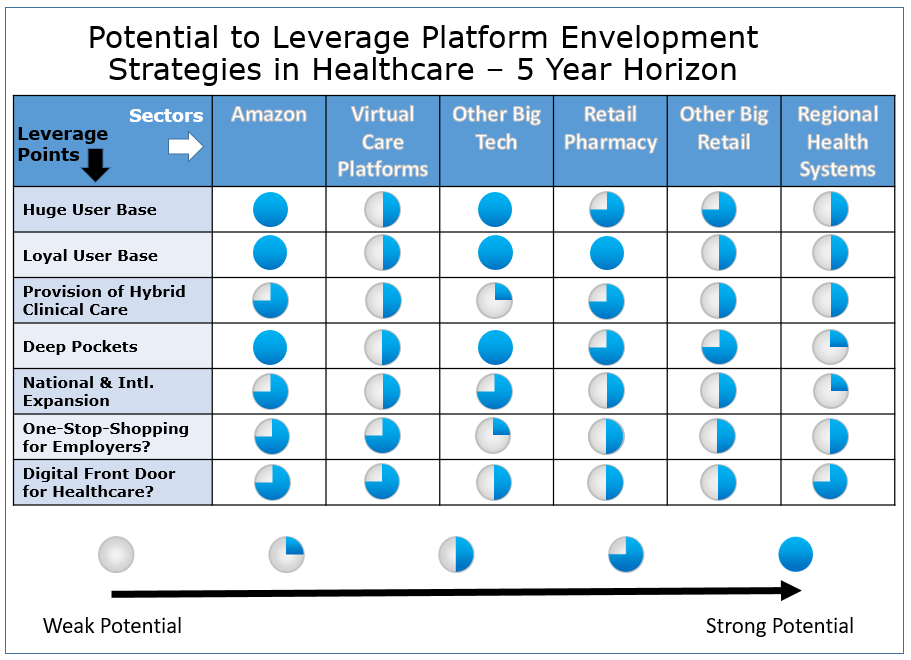

The graphic below summarizes our perspectives of Amazon’s leverage points and how these leverage points line up against major competitors. We set a 5 year time horizon.

Here are are some examples of companies in the competitor categories:

- Virtual care platforms (VCPs), e.g., AmWell, Teladoc

- Other Big Tech companies with healthcare offerings, e.g., Apple, Alphabet (Google)

- Retail pharmacy, e.g., Walgreens, CVS/Aetna

- Other Big Retail companies with healthcare offerings, e.g., Walmart, BestBuy

- Regional health systems, e.g., Intermountain Healthcare, Sutter Health

What we’re rating is specific — Amazon’s and competitors’ potential to leverage platform envelopment tactics within a five year horizon. We’ll be the first to point out that our ratings are subjective, and we hope you’ll use the framework to come to your own conclusions.

Discussion

We’ll offer some of our high-level takeaways from having gone through this exercise. First, let’s look across the columns at Amazon and each of its competitors:

Amazon has a strong potential to leverage multiple platform envelopment strategies. The strength and breadth of Amazon’s leverage points should not be underestimated.

When compared against competitors who’ve been around 20+ years, for virtual care platforms, it’s early in the game. VCPs are still building their own capabilities, both organically and through acquisition. And while their user bases have expanded greatly during COVID, there’s still a large percentage of the population that has yet to be exposed and brought on board.

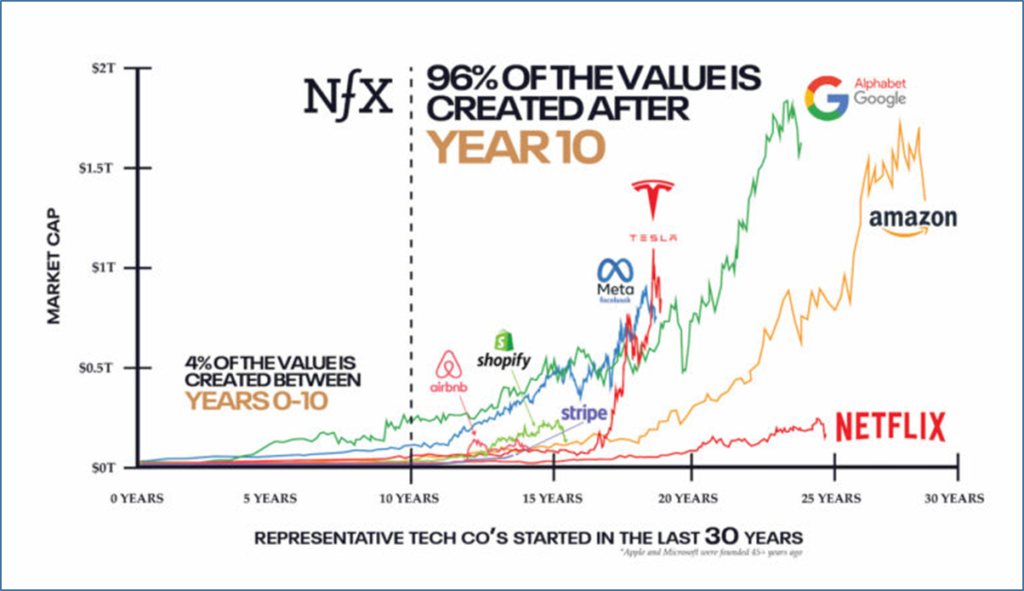

Dominant platforms do not typically form overnight. As documented by James Currier of NfX, many of today’s leading platforms accumulated most of their value only after 10 years:

Other Big Tech companies have large and loyal user bases and deep pockets, but most have been struggling with healthcare offerings. While Google has at least 57 startups in its portfolio, last year it disbanded its centrally positioned Google Health division when CEO David Feinberg departed for Cerner. An article in Business Insider reported on Apple’s struggles in healthcare.

Retail pharmacy chains are well positioned. They have large and loyal customer bases. Most of us fill our prescriptions at one store. Pharmacists are among the highest trusted healthcare professionals. Pharmacies already operate in the broader healthcare ecosystem and several pharmacy chains already have located clinical services within their stores. Finally, pharmacy chains have already built substantial consumer-focused digital infrastructure, e.g., apps, loyalty programs, automated refills).

Other Big Retail. While some retailers have large and loyal customer bases, they’re not in the same league as Amazon. Healthcare is foreign to most retailers. Walmart is one retailer that has made the strategic leap to provide in-person clinical services, but we don’t see many others with the scale or appetite to follow.

Compared to national and international Big Tech and Big retail platforms, most regional health systems don’t have a large user base, deep pockets, or the ability to serve large, national employers.

Perhaps the biggest challenge for regional health systems is simply “mindset”. In our experience most have not yet made the leap to think of themselves as platforms. Thus, the notion of deploying platform strategies is foreign. There are exceptions — Mayo Health System, Cleveland Clinic, Providence. We’ll have a lot more to say about this in future posts.

You might ask — “But aren’t patients loyal to their local health systems?” The numbers don’t support that conclusion. In this article in The Health Care Blog, you’ll see documentation that most patients use two or more health systems (#1), value convenience in provider selection (#2), and have declining levels of loyalty to local providers (#3).

Next, let’s look at some high-level takeaways at the leverage points in each of the rows:

As we documented, the size and loyalty of Amazon’s user base is unsurpassed. These are strong leverage points for a platform envelopment strategy.

Amazon has made the strategic leap to provide in-person clinical services. Health systems and some of Amazon’s largest competitors also have made this leap, but we doubt many others will do the same. Health systems have always provided in-person clinical services.

Amazon has among the deepest pockets, but this is less of a differentiator as most competitors also have deep pockets. Regional health systems are diverse — some are very strong financially, many others are weak.

While Amazon is well positioned to provide a comprehensive solution to employers, we see this as a challenging strategy. Employers currently “can” choose from hundreds of point solutions across a range of administrative, wellness, and clinical options. Consolidating many or most of these options will take time and effort. This is an area to watch.

Can Amazon become the digital front door for healthcare? Recall the statistic that 74% of U.S. consumers begin their product searches on the Amazon.com site. Healthcare is complex and offerings are diverse, so it’s likely that there will be multiple front doors, not one. While we view Amazon as bringing tremendous leverage, and this also is an area to watch.

Concluding Thoughts

Can Amazon be successful in healthcare? We see great potential for Amazon to leverage multiple potential envelopment strategies as steps toward success.

Many have been skeptical about the role that Big Tech or Big Retail might play. Healthcare incumbents who are far less familiar with the power and potential of platform business models should not be dismissive of these new entrants.

- Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part I)

- Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part II)

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 Unported License. Feel free to republish this post with attribution.